Environmental, Social & Governance (ESG) metrics that are thoughtfully chosen and linked to existing key performance indicators (KPI)s can add value and influence behavioral change.

Unintegrated ESG metrics are ineffective and misleading. Conversely, metrics that are thoughtfully chosen and intentionally implemented can impact both operations and organizational culture. Metrics drive organization strategy, which incentivizes and rewards specific behaviors. ESG metrics aim to drive positive operational and behavioral change that reduces overall impact on the planet.

However, popular metrics like purchased CO2 equivalents fail to influence operational or behavioral changes. At the beginning of 2023 Shell set aside more than $450 million to invest in carbon offsetting projects. Meanwhile, investigations indicated most carbon credits do not represent genuine emissions reductions1, and existing buffer pools of trees are burning down well before their 100 year estimated lifetime(2).

These initiatives continue the cycle of corporate greenwashing and public distrust. Generalized solutions are missing business context that would connect climate initiatives to business strategy. Through discovery, organizations could select metrics uniquely suited for them based on a deeper understanding of their business values and processes.

What is Discovery?

Discovery is an invaluable step in any project’s lifecycle that focuses on gaining understanding and alignment among various stakeholders. Critical and diverse perspectives make collective decisions that center around impact, feasibility, and values. Discovery can focus on a variety of initiatives, including selecting ESG metrics for an organization. Choosing the right metrics and integrating them with operational KPI’s can provide significant context to interpret outcomes within business operations and sustainability goals. You don’t have to reinvent the wheel. The purpose is to choose measures that are clear, reliably measured, and most importantly incentivizes decisions and behaviors that align with organizational goals and values. Below are suggested steps for discovery as it relates to choosing the right ESG metrics.

Step 1: Seek First to Understand

Gain clarity on current processes and initiatives. Make sure the right people are at the table. Each person taking part in discovery should have a different business role and therefore a different viewpoint. Give team members time to speak about their operations as it relates to the project at hand.

Step 2: Unite Around the Big Picture

Once business perspectives have been documented, the team will create a “big picture” process map of the present state. The team will collaborate to create a current representation that the team can agree on.

Step 3: Same Page, Same Path

Once the present state is mapped, the team will align on future goals. Each team member expresses their desired short and long-term outcomes associated with the project. Different personas will have different goals. This step will follow a similar process to capture everyone’s visions and the group align to one central vision. It’s important to come to consensus on the highest priority short term goals. Each goal should be put in either “Now”, “Next”, or “Later” categories.

Step 4: Pick or Create Metrics

Based on organizational goals and initiatives, what ESG metrics drive desired behaviors? Search for ESG metrics currently being used in the industry as well as brainstorming organization-specific metrics. Consider potential positive and negative impacts of implementing these metrics. Each team member offers metrics, provides definitions, and outlines how they will integrate with existing KPI’s.

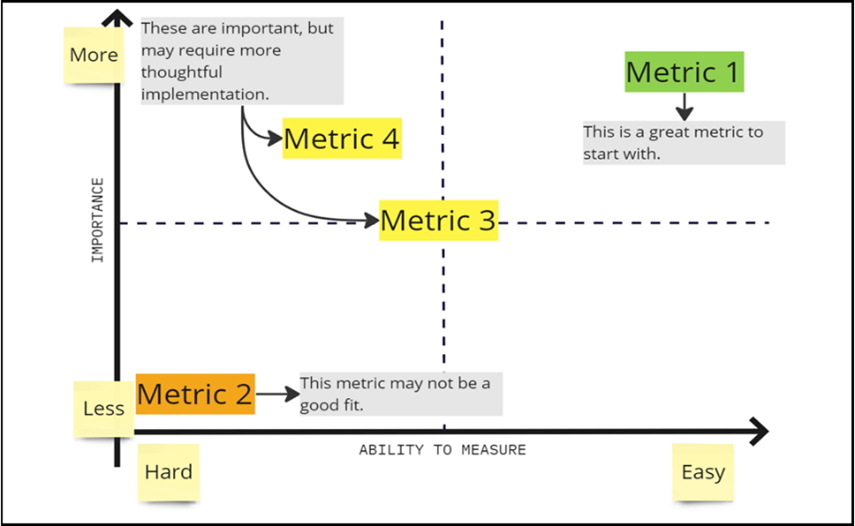

Step 5: Rank Your Metrics

How important is this metric to creating a link between operational practices and your organization’s sustainability initiatives? How hard is it to measure? Each metric should be discussed and ranked. Rank them using a method like the matrix below. Determine if any of these metrics might provide perverse incentives. Could this metric unintentionally drive negative behaviors to optimize output? Metrics with these risks may need to be tabled or altered.

Step 6: Prioritize and Align

Once rankings are complete, prioritize your metrics similarly to your goals by placing them in “Now”, “Next” or “Later” categories. Discuss how many metrics are feasible to start measuring and implementing “now”. Discuss and align on outstanding concerns or issues, and then place metrics along the project timeline accordingly.

Step 7: Prototype, Test, Repeat

Create a plan for how to bring these metrics online and how to evaluate their efficacy. Thoughtful implementation is key. These metrics are not the targets, they’re tools to measure impact and understand outcomes of ESG initiatives. Effective and integrated ESG metrics give feedback on environmental impact and business impact. Repeat the discovery process as necessary until metrics provide valuable and actionable information.

Key Discovery Takeaways

- ESG metrics that aren’t thoughtfully chosen and integrated fall short of driving positive change.

- Discovery can help bridge the gap between chosen metrics and desired outcomes.

- Integrating metrics with existing KPI’s provides context and clarify value-add of ESG initiatives.

- Metrics are MEASURES of progress towards the goal. They ARE NOT the target.

Let’s connect and discuss!

Shoot me an email: jessie@www.analyticvizion.com